If you are a Malaysian employer registered under the Human Resource Development Corporation (HRD Corp), you may already know that you are entitled to make a HRD Corp claim for your employees’ training costs. But the most common question employers ask is: “How much can I actually claim for HRD Corp?”

In this blogpost, we’ll break it down in simple terms so you can maximize your training budget while staying compliant.

What Is HRD Corp?

HRD Corp (formerly known as HRDF) is an agency under the Ministry of Human Resources that manages the Human Resources Development Fund. Registered employers contribute a percentage of their monthly payroll to HRD Corp. These contributions can then be claimed back to fund employee training and upskilling programs.

How Much Can You Claim from HRD Corp?

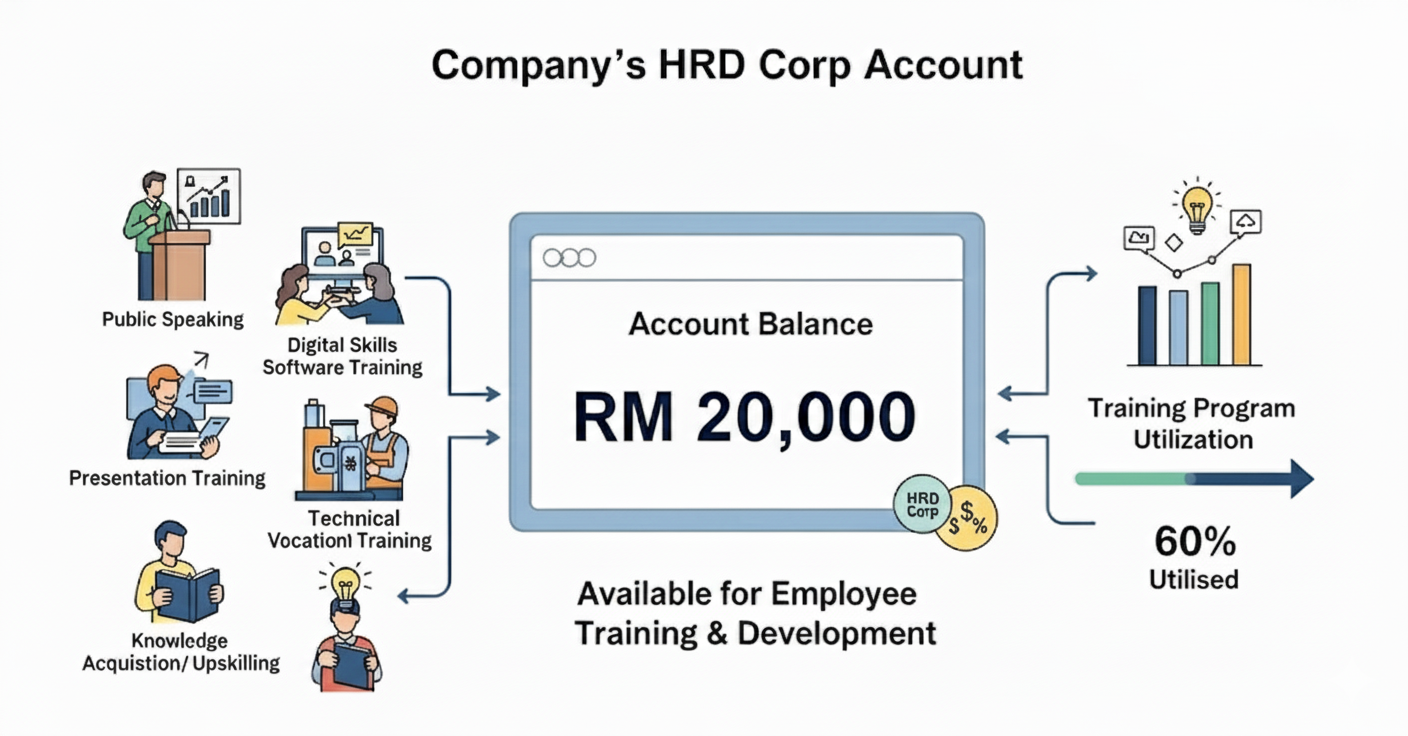

The amount you can claim depends on a few factors:

1. Your Levy Balance

Here’s how it works:

-

Employers contribute 1% (for companies with 10 or more employees) or 0.5% (for companies with 5–9 employees) of their monthly payroll.

-

The total contributions accumulated in your HRD Corp account determine your available HRD Corp claim balance.

-

You can claim up to the amount you have in your account.

👉 Example:

If your company has RM20,000 in your HRD Corp levy account, you can claim training programs up to RM20,000.

2. Type of Training Scheme

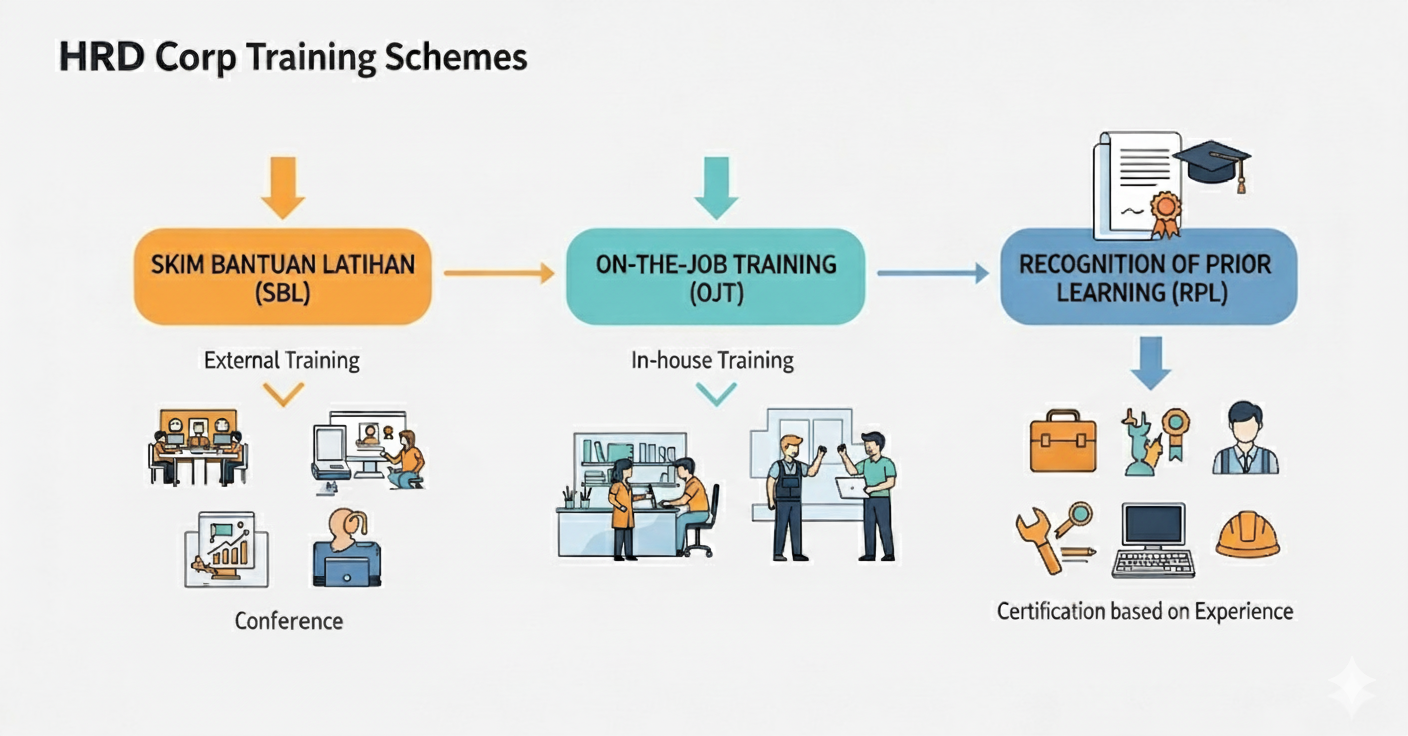

HRD Corp offers various schemes, including:

-

Skim Bantuan Latihan (SBL) – For external training providers.

-

On-the-Job Training (OJT) – For in-house or workplace training.

-

Recognition of Prior Learning (RPL) – For employees to get certified based on experience.

Each scheme may have its own claimable rates and allowable costs.

3. Allowable Costs

HRD Corp covers:

-

Training fees (from approved providers)

-

Trainer allowances

-

Daily allowances for participants

-

Meals and accommodation (if applicable)

-

Training materials

The actual claimable amount depends on the course and approval guidelines.

How to Check Your HRD Corp Claim Balance

You can log in to your e-TRiS account on the HRD Corp portal to view:

-

Your current levy balance

-

Previous claims

-

Training approvals

This helps you plan which training programs to prioritize within your available budget.

Final Thoughts

So, how much can you claim for HRD Corp? The simple answer is: up to the amount in your levy balance, depending on the scheme and allowable costs.

By understanding the claim process and planning your training strategically, you can make full use of your HRD Corp contributions to upskill your workforce and drive business growth.