Are you a business owner or HR manager confused about the HRD Corp (formerly known as HRDF) levy?

You are not alone. Many employers in Malaysia often ask: “Is my business required to register?” or “How much do I actually need to contribute every month?”

Understanding the Pembangunan Sumber Manusia Berhad Act 2001 (PSMB Act 2001) is critical. Failure to register not only deprives your team of training opportunities but can also land your company in legal trouble.

This article breaks down exactly who needs to pay HRD Corp, the applicable levy rates, and how to calculate them.

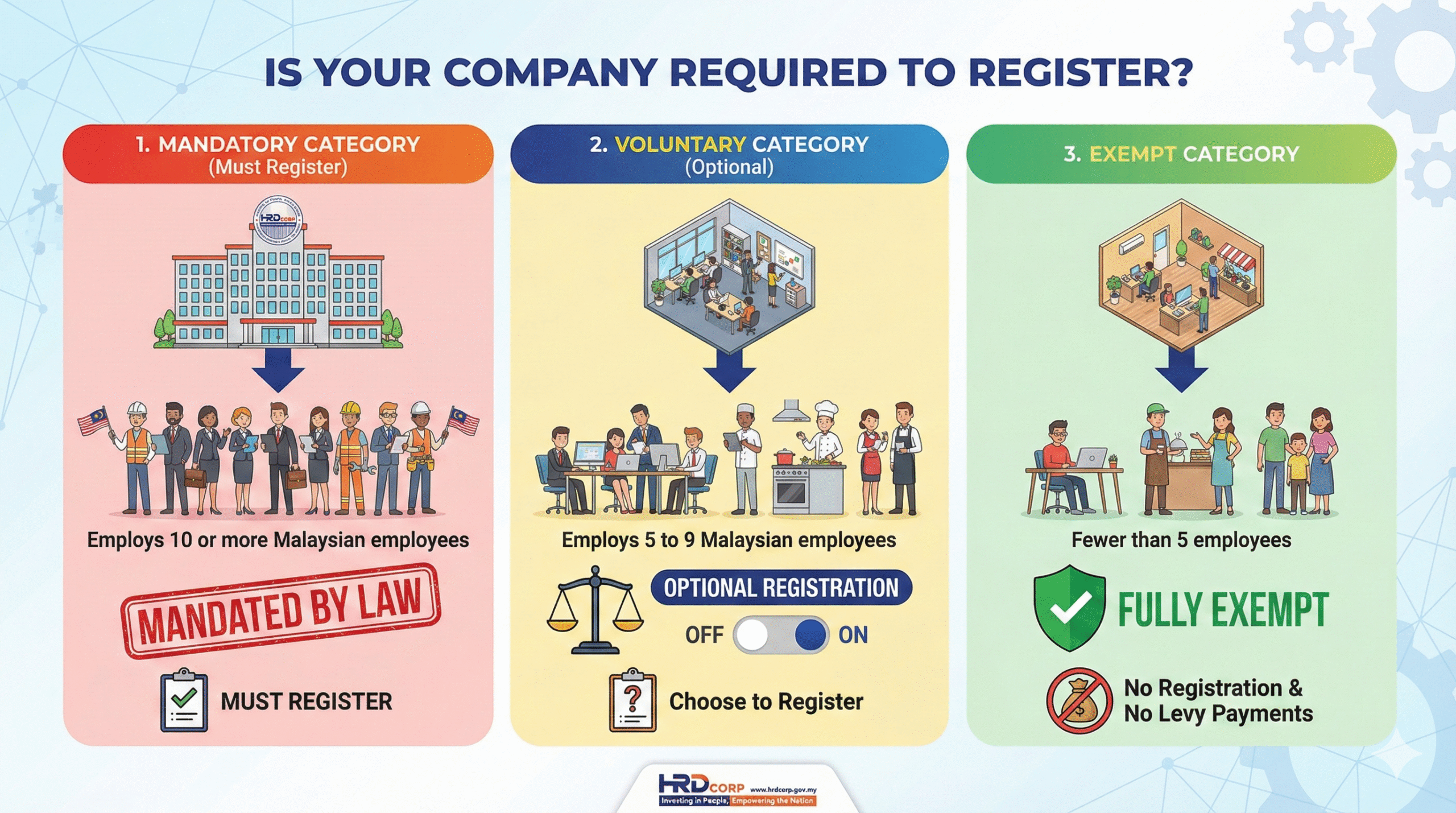

Is Your Company Required to Register?

Generally, the obligation to register depends on the number of Malaysian employees you currently employ. Since the expansion of the Act in 2021, almost all industries are now covered.

Here is the breakdown:

1. Mandatory Category (Must Register) If your company employs 10 or more Malaysian employees, you are MANDATED by law to register with HRD Corp.

Levy Rate: 1% of the employees’ monthly wages + fixed allowances.

2. Voluntary Category (Optional) If your company employs 5 to 9 Malaysian employees, registration is OPTIONAL.

-

Levy Rate: 0.5% of the employees’ monthly wages + fixed allowances.

-

Note: Even though it is voluntary, many employers choose to register to access government-subsidized training schemes.

3. Exempt Category Companies with fewer than 5 employees are fully exempt from registration and levy payments.

Which Industries Are Covered?

Previously, only specific manufacturing sectors were involved. However, under the Pembangunan Sumber Manusia Berhad (Amendment of First Schedule) Order 2021, coverage has expanded to almost all major sectors, including:

-

Services

-

Manufacturing

-

Mining & Quarrying

-

Construction

-

Agriculture & Forestry

How to Calculate the HRD Corp Levy

The levy calculation is based on Basic Salary + Fixed Allowances.

The Formula:

Example Scenario:

Company XYZ has 15 employees (Mandatory 1% Category).

An employee named Sarah earns a basic salary of RM3,000 and a fixed allowance of RM500.

Calculation: (RM3,000 + RM500) x 1% = RM35.00

Company XYZ must contribute RM35.00 per month for Sarah to HRD Corp.

What counts as Fixed Allowance?

Any allowance paid monthly that does not vary (e.g., fixed transport allowance, distinct phone allowance). Variable allowances like Overtime (OT) or sales commissions are excluded from this calculation.

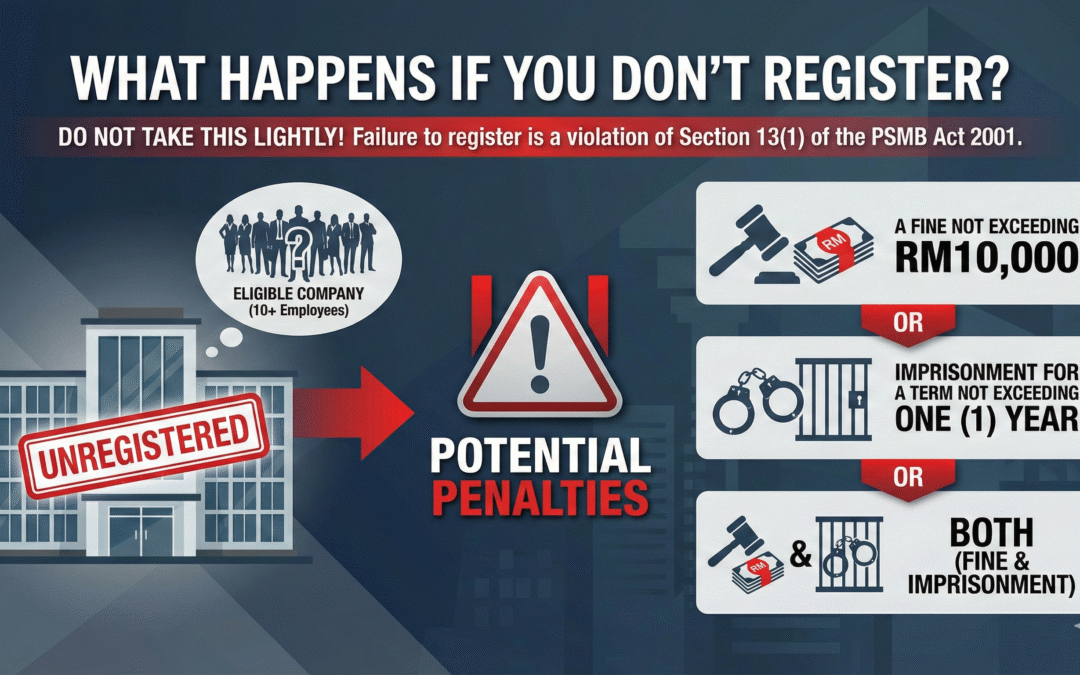

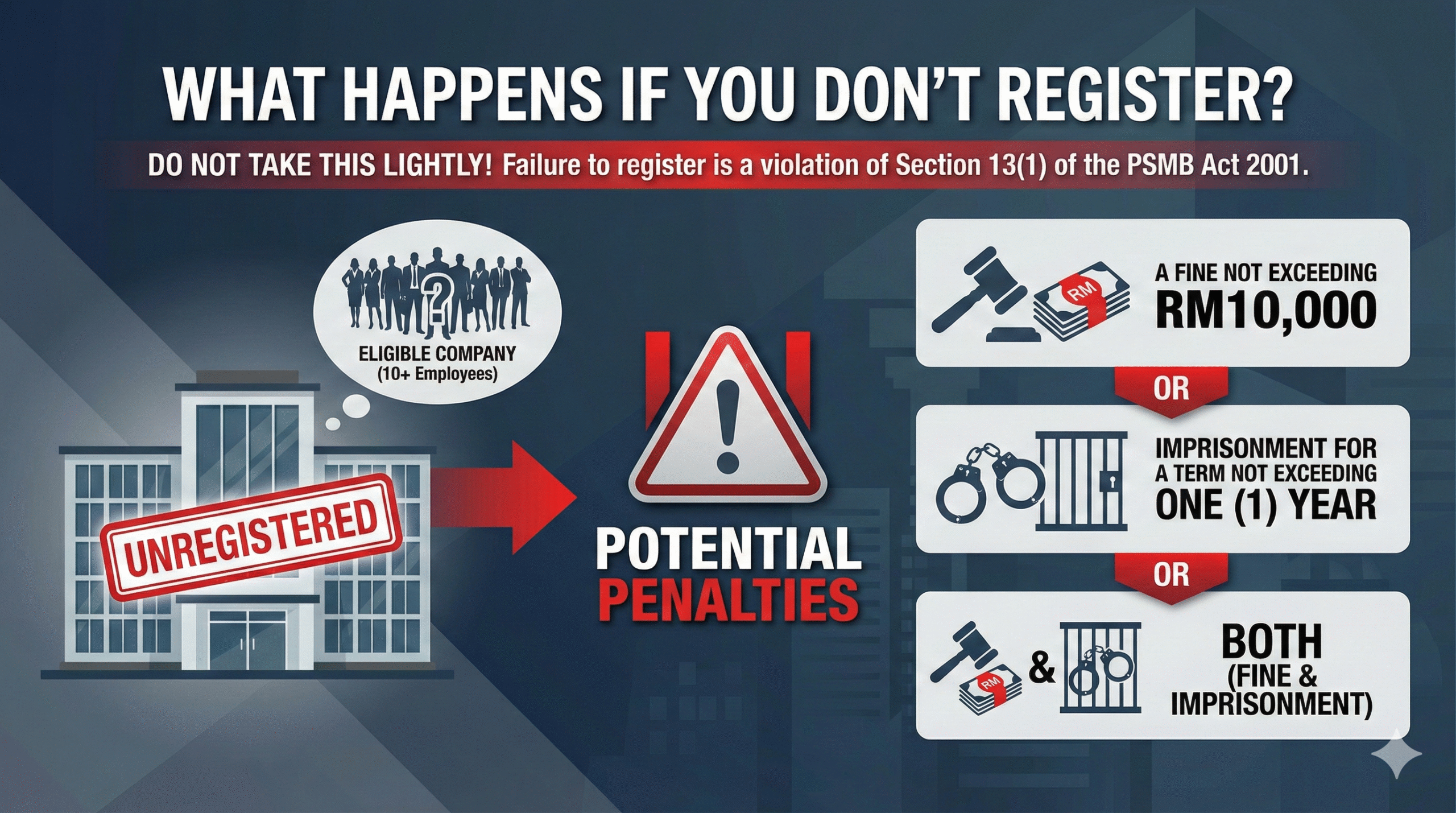

What Happens If You Don’t Register?

Do not take this lightly! If your company is eligible (has 10+ employees) but fails to register, you are violating Section 13(1) of the PSMB Act 2001.

Potential Penalties:

-

A fine not exceeding RM10,000, OR

-

Imprisonment for a term not exceeding one (1) year, OR

-

Both

Why Should You Pay? (Benefits for Employers)

Paying the levy isn’t just an expense; it is a savings fund for your company’s growth.

1. HRD Corp Claimable Courses: You can send employees for training (like Digital Marketing, Leadership, or AI) and claim back 100% of the cost from your levy fund.

2. Increased Productivity: Trained employees work more efficiently, directly impacting your bottom line.

3. Tax Relief: Employer contributions to HRD Corp are eligible for tax deductions.

Conclusion

Now you know who needs to pay HRDC. If your workforce exceeds 10 Malaysians, check your registration status immediately to ensure compliance. View this contribution as an investment in upskilling your team, rather than a sunk cost.

Still confused about registration or how to claim for training? Contact us today for a free consultation on our HRD Corp Claimable training programs!

Resources:

1. https://hrdcorp.gov.my/registered-employers

2. https://hrdcorp.gov.my/expansion-of-psmb-act-2001/

3. https://hrdcorp.gov.my/levy-payment/

4. https://etris.hrdcorp.gov.my/

5. https://hrdcorp.gov.my/employer-faq/